Quickbooks Payroll Expenses Vs Liabilities . if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. But are they the same thing? Payroll liabilities are amounts you owe but haven’t paid yet. Payroll deductions as liabilities vs. Payroll expenses every business must record payroll liabilities and payroll expenses. payroll liabilities vs. finance your business. this amount is always gross. If you’ve come across payroll liabilities before, you’ve probably heard of payroll expenses. The short answer is not quite. what is the difference between a payroll expense and liability? Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. As a business owner, payroll expenses are the costs involved in running a. Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits.

from lendahandaccounting.com

Payroll liabilities are amounts you owe but haven’t paid yet. Payroll expenses every business must record payroll liabilities and payroll expenses. payroll liabilities vs. If you’ve come across payroll liabilities before, you’ve probably heard of payroll expenses. Is a salary expense a liability, for example? Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. The short answer is not quite. payroll liabilities versus payroll expenses. As a business owner, payroll expenses are the costs involved in running a. what is the difference between a payroll expense and liability?

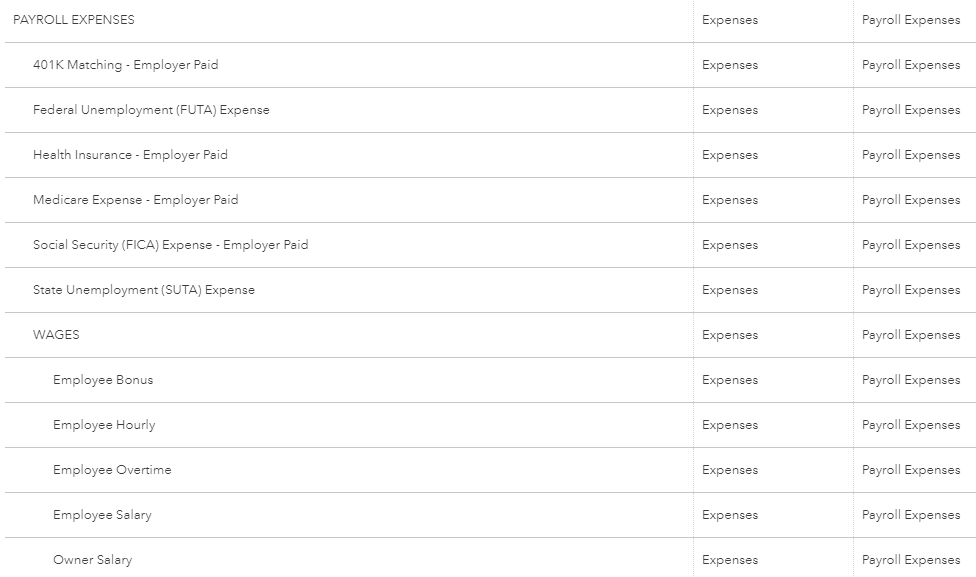

The Chart of Accounts List Builds Your QuickBooks Online Company

Quickbooks Payroll Expenses Vs Liabilities this amount is always gross. overall, payroll liabilities vs payroll expenses are two very different things. finance your business. Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. As a business owner, payroll expenses are the costs involved in running a. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your. If you’ve come across payroll liabilities before, you’ve probably heard of payroll expenses. Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. Payroll expenses every business must record payroll liabilities and payroll expenses. Is a salary expense a liability, for example? Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. Payroll liabilities are amounts you owe but haven’t paid yet. payroll liabilities vs. what is the difference between a payroll expense and liability? this amount is always gross. The short answer is not quite.

From www.youtube.com

RECORDING PAYROLL EXPENSES, PAYROLL LIABILITIES AND MAKING PAYROLL Quickbooks Payroll Expenses Vs Liabilities But are they the same thing? As a business owner, payroll expenses are the costs involved in running a. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. this amount is. Quickbooks Payroll Expenses Vs Liabilities.

From www.upwork.com

Payroll Liabilities Basics, Examples, and How to Calculate Quickbooks Payroll Expenses Vs Liabilities Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. Payroll expenses every business must record payroll liabilities and payroll expenses. payroll liabilities vs. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. if you have quickbooks payroll for desktop,. Quickbooks Payroll Expenses Vs Liabilities.

From longforsuccess.com

How to create a monthly Profit & Loss report in QuickBooks Long for Quickbooks Payroll Expenses Vs Liabilities Payroll liabilities are amounts you owe but haven’t paid yet. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. overall, payroll liabilities vs payroll expenses are two very. Quickbooks Payroll Expenses Vs Liabilities.

From www.youtube.com

The Difference between Bill and Expense in QuickBooks Online YouTube Quickbooks Payroll Expenses Vs Liabilities Payroll expenses every business must record payroll liabilities and payroll expenses. Is a salary expense a liability, for example? payroll liabilities versus payroll expenses. As a business owner, payroll expenses are the costs involved in running a. The short answer is not quite. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and. Quickbooks Payroll Expenses Vs Liabilities.

From qbkaccounting.com

Basic Chart of Accounts in QuickBooks Online Experts in QuickBooks Quickbooks Payroll Expenses Vs Liabilities Payroll liabilities are amounts you owe but haven’t paid yet. finance your business. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. But are they the same thing? Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees.. Quickbooks Payroll Expenses Vs Liabilities.

From www.youtube.com

QuickBooks Online Plus 2017 Tutorial Paying Payroll Tax Liabilities Quickbooks Payroll Expenses Vs Liabilities payroll liabilities vs. this amount is always gross. what is the difference between a payroll expense and liability? Payroll deductions as liabilities vs. Is a salary expense a liability, for example? Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. Payroll expenses are the amounts an employer. Quickbooks Payroll Expenses Vs Liabilities.

From fitsmallbusiness.com

How to Reconcile Payroll Liabilities in QuickBooks Payroll Quickbooks Payroll Expenses Vs Liabilities payroll liabilities vs. Payroll deductions as liabilities vs. Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. The short answer is not quite. As a business owner, payroll expenses are the costs involved in running a. Payroll liabilities are amounts you owe but haven’t paid yet. Payroll expenses every business. Quickbooks Payroll Expenses Vs Liabilities.

From qasolved.com

How to Enter Expenses in QuickBooks? QASolved Quickbooks Payroll Expenses Vs Liabilities Payroll liabilities are amounts you owe but haven’t paid yet. Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. Payroll expenses every business must record payroll liabilities and payroll expenses. what is the difference between a payroll expense and liability? Payroll deductions as liabilities vs. If you’ve come across payroll. Quickbooks Payroll Expenses Vs Liabilities.

From www.slideteam.net

Payroll Expenses Vs Payroll Liabilities Ppt Powerpoint Presentation Quickbooks Payroll Expenses Vs Liabilities this amount is always gross. If you’ve come across payroll liabilities before, you’ve probably heard of payroll expenses. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. Is a salary expense a liability, for example? As a business owner, payroll expenses are the costs involved in running a. . Quickbooks Payroll Expenses Vs Liabilities.

From www.sterling.cpa

Payroll Liabilities vs Payroll Expenses What Are the Differences? Quickbooks Payroll Expenses Vs Liabilities Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. overall, payroll liabilities vs payroll expenses are two very different things. Payroll expenses are the amounts an employer pays. Quickbooks Payroll Expenses Vs Liabilities.

From fitsmallbusiness.com

How to Reconcile Payroll Liabilities in QuickBooks Payroll in 6 Easy Steps Quickbooks Payroll Expenses Vs Liabilities Payroll expenses every business must record payroll liabilities and payroll expenses. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your. If you’ve come across payroll liabilities before, you’ve probably heard of payroll expenses. payroll liabilities versus payroll expenses. But are they the same thing? Only. Quickbooks Payroll Expenses Vs Liabilities.

From lendahandaccounting.com

The Chart of Accounts List Builds Your QuickBooks Online Company Quickbooks Payroll Expenses Vs Liabilities if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your. what is the difference between a payroll expense and liability? But are they the same thing? The short answer is not quite. Only after you subtract everything you owe to third parties will you get a. Quickbooks Payroll Expenses Vs Liabilities.

From qbkaccounting.com

Payroll Liability vs Expense Experts in QuickBooks Consulting Quickbooks Payroll Expenses Vs Liabilities payroll liabilities versus payroll expenses. Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. finance your business. this amount is always gross. Payroll expenses every business must record payroll liabilities and payroll expenses. The short answer is not quite. Is a salary expense a liability, for example? . Quickbooks Payroll Expenses Vs Liabilities.

From www.patriotsoftware.com

What Are Payroll Liabilities? Definition and How to Track Quickbooks Payroll Expenses Vs Liabilities Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your. finance your business. If you’ve come across payroll liabilities before, you’ve probably heard of payroll. Quickbooks Payroll Expenses Vs Liabilities.

From ebizcharge.com

What’s the Difference Between Accounts Payable and Expenses? Quickbooks Payroll Expenses Vs Liabilities payroll liabilities versus payroll expenses. Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. Is a salary expense a liability, for example? if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded when your. If you’ve. Quickbooks Payroll Expenses Vs Liabilities.

From www.wizxpert.com

How to Adjust Payroll Liabilities in QuickBooks Desktop Quickbooks Payroll Expenses Vs Liabilities Payroll liabilities are amounts you owe but haven’t paid yet. what is the difference between a payroll expense and liability? Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded. Quickbooks Payroll Expenses Vs Liabilities.

From fitsmallbusiness.com

How to Reconcile Payroll Liabilities in QuickBooks Payroll Quickbooks Payroll Expenses Vs Liabilities Payroll expenses are the amounts an employer pays out to cover the cost of employee salaries and benefits. Only after you subtract everything you owe to third parties will you get a net pay that’s given to your employees. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a quick way to be reminded. Quickbooks Payroll Expenses Vs Liabilities.

From quickbooks.intuit.com

Payroll expenses Your small business guide QuickBooks Quickbooks Payroll Expenses Vs Liabilities Is a salary expense a liability, for example? Payroll liabilities are the amounts an employer withholds from an employee’s paycheck to pay taxes and other required deductions. what is the difference between a payroll expense and liability? payroll liabilities versus payroll expenses. if you have quickbooks payroll for desktop, tracking and paying payroll liabilities can be a. Quickbooks Payroll Expenses Vs Liabilities.